Back when I was a youth (yes, it was before TV, Taco Bell, and Twitter) when milk was delivered to our house by an actual milkman, we used to get our entertainment in the Summer (and get out of our parent’s hair) by attending local movie theaters. We’d walk over to the Ramona Theater on Gratiot and McNichols (6 Mile to natives of “The Strait”) and catch the Saturday matinee, usually featuring a western where the good guys wore white hats (and were white), a serial where Commander Cody saved the world from creepy denizens of another country or alternate universe, and in between a cartoon, usually starring some Warner Brothers character like Bugs Bunny or Yosemite Sam with the voice of Mel Blanc (“white” as well) who wisecracked through some slapstick routine extolling the merits of hoarding carrots or gold at the expense of swarthy varmints bent on world domination or socialism.

Sometimes the cartoon was a “sing-a-long”, sort of a precursor to karaoke, where the audience was invited by the “performers” on screen to join in with a rendition of a popular song. It didn’t matter if you could carry a tune or not, you’d be drowned out by the chorus of caterwalling that came from the audience as a whole anyway, usually pre-pubescent males with high voices. In order to keep everyone on tempo and in time with the performers, there would be a line of subtitles displaying the lyrics along with a white bouncing ball which would undulate along the text in time with the music as an aid to the tone deaf. The captive audience was then prompted to ‘”follow the bouncing ball” and join the group in destroying some classic by Cole Porter or Lerner and Lowe a la Mitch Miller.

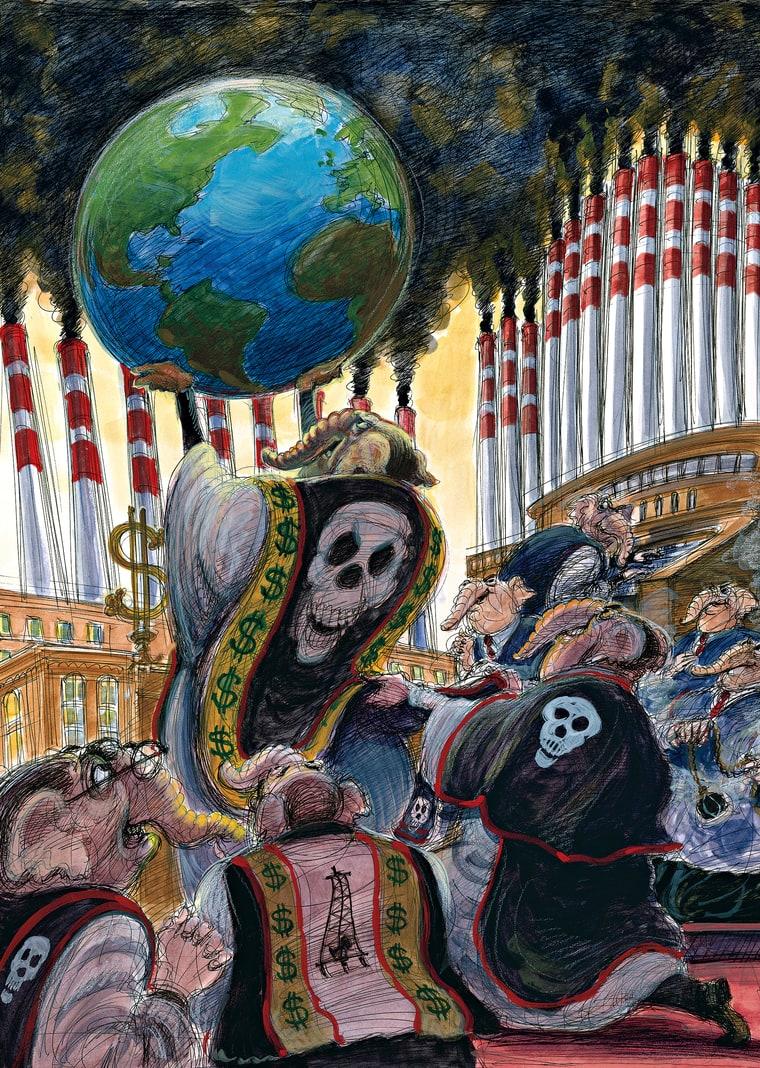

Well, keeping up with the spirit of group participation, no matter how painful or redundant, I’d like to invite you to “follow the bouncing ball” as we try to fathom all of this immigrant-bashing and debt ceiling bullshit that is being pumped down our throats as partisan politics, government ineffectiveness, the need for austerity when it comes to pensions & entitlements, and the criminalization of women, the working class and the poor as a drain on the economy. The “ball” in this case in money. And the “bounce” is profits. It is all about profits. Here is the plan.

Let’s take as an example the real targets here, Social Security and Medicare. The Social Security Trust was created by congress and FDR in the 1930’s to in part ensure that seniors had at least some modicum of financial support in their declining years. The Trust and Medicare are (still) supported by contributions from payroll taxes matched by employers from current workers.; the ultimate “paying it forward” scenario. After all, you’ll be seniors some day too, right? All things being equal (the rate and wage ceiling) the more workers that are employed, the higher the contributions to the Trust. The fewer the number of employed workers, the fewer the taxes that are collected and the lower the contributions to the Trust and to Medicare. But the important thing to remember about the Social Security Trust is that by law it is self funded and does not contribute one red cent to the National Debt [which now exceeds $1 trillion annually]. What is in the Trust? What kind of assets are held in it? Gold? Cash? Securities? Right now most of the assets in the Trust are US Treasury Bonds. Why just Treasuries? Good question.

US Treasury Bonds are considered by governments and financial institutions around the world as a safe bet, backed by the respect and faith in the US government. Investors feel that Treasuries are relatively liquid – they can recoup their investments relatively easily by trading them on securities markets or selling them back to the Federal Reserve in exchange for other forms of debt. The banks can borrow from the Federal Reserve at next to zero interest, then turn around and leverage more loans for up to 50 times the original amount they borrowed using Treasuries as “reserves” to meet Dodd-Frank guidelines for liquidity thresholds. The one glaring shortcoming with Treasuries is that they carry a small return for the investor, less than 1% or nearly zero depending on market conditions. What does this mean for the Social Security Trust?

It means the Trust is earning close to zero on the “assets” it holds. This is so because of a least two reasons. The first is to make it appear that the Trust is in trouble because the perceived value of its holdings are not increasing In comparison to “yields” shown by the Stock Market, thus fueling concern about it going bankrupt sometime in the future. The second reason is tied to the ongoing charade of governing by crisis currently being deployed by right wing elements funded by Neoliberal corporate interests bent on privatizing all aspects of the social safety net. If the government is shown to be incapable of managing its finances, then Wall Street must take over (because they’ve been so competent at managing theirs and ours in the past).

The best way of proving that the government is being mis-managed is to shut it down by refusing to pay for commitments that it has already made. What this action will do is create mistrust and fear on international markets so that Treasuries holders (like the BRICS nations) will cash out glutting the market and forcing the value of Treasuries already on the market to decline since no one wants them … plus causing market rates for new Treasuries to effectively increase to the point that the U.S. government cannot afford to issue new ones because of the increased debt service “demanded” by investors who would not otherwise buy them. This scenario would then further depress the asset holdings of the Social Security Trust fueling more demands to change it by, among other options, turning it over to the gamblers whom have rigged the game to begin with.

Remember, the lifeblood of Neoliberal Capitalism is debt. In this mutant form of capitalism, creating money from nothing also produces debt. Debt is also its Achilles Heel. If you reduce the debt, you shrink the economy by taking money out of it that otherwise would stay in circulation, producing income, creating jobs, fueling growth and —- oh yeah — help to fund the Social Security Trust, Medicare and replenish the Treasury with tax revenues.

So who gets saddled with paying back all of this debt; the banking corporations who created the debt in the first place or the entities whom agreed to take it on? That would be too logical. You’ve heard of derivatives? They’re essentially a huge interlocking network of Ponzi schemes; insurance policies taken out by speculators who create debt, indemnifying themselves against any financial responsibility for default, that in turn can be marketed as securities to investors like countries, municipalities and 401K plans as hedges against market fluctuations usually secured by tranches of debentures or mortgages re-branded as bespoke tranche opportunities — in other words — debt backed up by more debt that by most recent estimates totals more than $1.2 Quadrillion.

In the Neoliberal austerity game plan, when these bets go South, it is the taxpayer who is on the hook because the meme “faith in government” means indemnification up by its people. Just look at those so-called “lazy Greeks” with all their social programs and all that debt they owe to the ECB and the IMF. A debtor should really not be entitled to a social safety net. A debtor’s only right is to pay. Never mind that all of that Greek debt was created by private enterprise in the free market economy. Again, follow the bouncing ball to the money. And by the way, the real entitlement here is the “bounce”; the interest on all this debt which is — profit for the Rentier Class.

The way out of this downward spiral for the Trust and the government as a whole would be to eliminate the debt ceiling altogether by decreeing a debt jubilee; use fiat currency programs to increase employment by investing in infrastructure; gut funding for the Forever War machine; impose new taxes – first a 70-80% on all accumulated wealth held by entities of more than $1 Billion, and second a .25% tax on all Wall Street and FIRE sector transactions; raise both the contribution rate (now at 12.4%) and annual compensation limit (projected for 2019 to be $132,900) to Social Security; move all health care coverage to a single payer system like Medicare; and create a Universal Basic Income [UBI] – universally.

Of course none of this is likely to happen while the congress remains under the bilateral. bi-polar, neoliberal capitalist duopoly that functions solely for the benefit of the Rentier Class…so convert your money — if you have any — to cash and put it in a Public Bank. Get out of stocks, bonds and Real Estate which are really bets on the value of debt; do not invest in Bit Coin [$50K per coin current market] or even blockchain tech because AI’s are about to take over that part of the the Finance market [if it hasn’t already], which is the latest flavor of what is essentially a Ponzi Scheme. If you’re in on the ground floor you’re cool; but if you’re “johnny come lately” just go to Vegas and place your wad on the “Come Line”. Seriously, this is what neoliberal capitalism is — one massive “shell game” in which The House always wins because it owns both the Shell and the casinos which is leveraged to the one-arm bandits anyway. We will never be the House, so let’s just burn that House down.

“Do not go gentle into that good night,

Old age should burn and rave at close of day;

Rage, rage against the dying of the light.”….Dylan Thomas

BDS.

© Kazkar Babiy ™ MMXIII

Updated from the original October 13, 2013 post.

This work is published by www.parrhesiastes.net © MMXIII All Rights Reserved.